Navigating the Tariff Storm: Data-Driven Strategies for Global Trade Resiliencere

🌐 1. The New Tariff Landscape: Heatmaps & Policy Shifts

Trump 2.0 tariffs have ignited a chain reaction:

200% duty on aluminum of undetermined origin (effective June 2025) 1

145% tariffs on Chinese goods and 50% on steel appliances, triggering Mexico/Canada retaliations 19

60+ countries now face U.S. tariffs >20%, with exemptions only for energy and U.K. metals 1

Chart Recommendation:

“2025 Global Tariff Heatmap”

Data Source: WTO Tariff Profiles (2023) 8 + CEIC tariff tracker 1

Visual: Interactive map with drill-down by country/commodity. Hover reveals bound vs. applied rates.

📉 2. Trade Flow Disruptions: Sankey Diagrams

Pre-tariff stockpiling masked underlying fragility:

Q1 2025 surge: WTO Trade Index hit 103.5 (containers: 107.1) as importers raced deadlines 9

Q2 collapse: New export orders plunged to 97.9 – lowest since 2020 9

Diverging pathways: Mexican auto exports to U.S. ↑ 18% (nearshoring), Chinese electronics ↓ 29% 1

Chart Recommendation:

“Trade Flow Sankey Diagram (2024-2025)”

Data: Oxford Economics TradePrism (46 economies, 1,200 products) 4

Visual: Animated flow lines showing export redirection from China → Mexico/Vietnam.

⚖️ 3. Sectoral Impact Radar Charts

Material costs are decimating margins:

| Sector | Cost Surge (Feb-May 2025) | Primary Trigger |

|---|---|---|

| Industrial Packaging | Aluminum ↑ 139% | “Originless metal” tariffs |

| Automotive | Steel ↑ 77% | Reciprocal auto duties |

| Electronics | Rare earths ↑ 210% | Green tech subsidies |

Chart Recommendation:

“Cost Inflation Radar”

Axes: Metals, plastics, bio-materials, logistics, labor

Outliers: Bio-packaging firms (NEXE) show 12% cost reduction

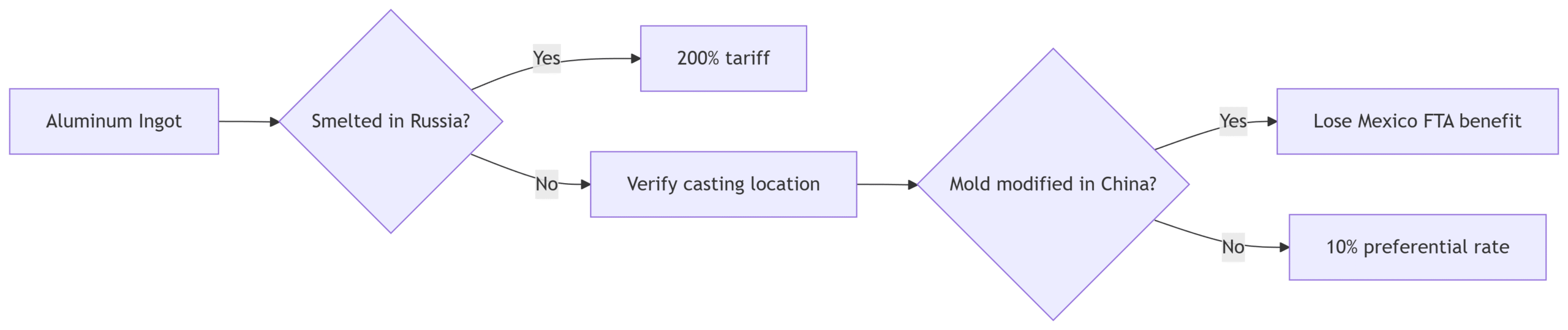

🧩 4. Rules of Origin Complexity: Flowcharts

Preferential origin rules are now make-or-break: